Mortgage Calculator: How Much Can I Borrow?

Table of Content

The most important thing isn’t how much money you earn, but rather, that your income meets a few key requirements. The most recognized 3.5% down payment mortgage in the country. Many people wonder whether they should buy a house or wait and continue to rent. Certain advantages come with renting, and waiting can give you time to improve your credit or save up for a down payment.

This is a major factor because it shows how stable and predictable your finances are. Having a high income with stable employment lowers default risk for lenders. Thus, you have higher chances of qualifying for a mortgage with a long-term job and reliable sources of income. Deciding to buy a house is a primary financial commitment. It’s one of the most expensive major purchases you’ll make in a lifetime. And for most people, it can take decades to pay down a mortgage.

$500 Monthly Payment Breakdown

Mortgage pre-approval should not be confused with mortgage pre-qualification, where you tell a lender about your income and debts but don’t provide documentation to verify your claims. It provides a general estimate of possible mortgage payment and/or closing cost amounts and is provided for preliminary informational purposes only. Your own mortgage payment and closing cost amounts will likely differ based on your own circumstances.

Since your credit score is a major factor in your ability to get a home loan, it’s worth your time and effort to improve it. To do so, pay all of your bills on time as even one late or missed payment can ding your score. Also, catch up on any past-due accounts and make payments on any revolving accounts like credit cards and lines of credit. The mortgage pre-qualifying process is an informal assessment of your ability to repay a loan.

Required Income Calculator for a Mortgage Calculator

Your DTI ratio tells lenders the monthly mortgage payment you can afford. We're able to do this by not only considering the loan amount and interest rate but the additional factors that affect your ability to qualify for a mortgage. We include your other debts and liabilities that have to be paid each month and costs like taxes and homeowner's insurance that are part of the monthly mortgage payment. Doing so makes it easy to see how changes in costs and mortgage rates impact the home you can afford. Determining the monthly mortgage payment you qualify for is similar to calculating the maximum mortgage loan you can afford. All you have to do is enter the value of your annual income and the length of your loan on the mortgage qualifying calculator, and it will display the monthly payment you should expect.

This shows how much money you have “left over” each month for a mortgage payment. Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some borrowers opt for shorter loan terms.

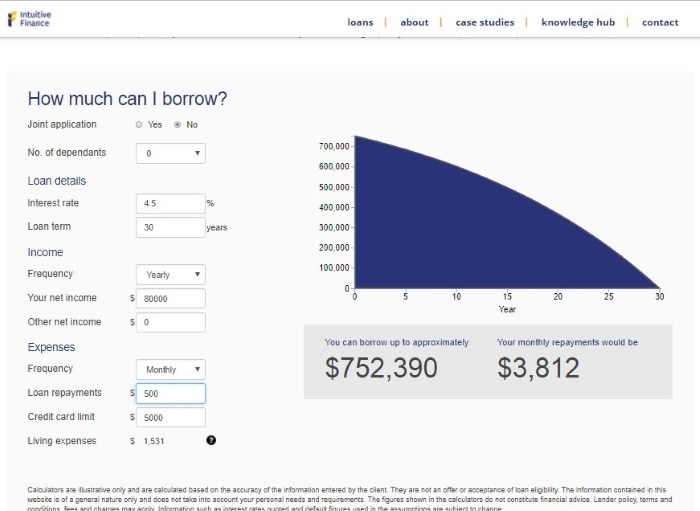

How Much Can I Borrow?

Our calculator assumes a property tax rate by default, but you can edit this amount in the calculator's advanced options. To obtain a more accurate total payment amount, get pre-qualified by a lender. Your credit score is a three-digit number that shows how responsible you are as a borrower. A high credit score shows lenders that you’re likely to repay your home loan on time and in full while a lower score signifies you might fall behind on your payments or default. Therefore, homebuyers with high credit scores tend to qualify for a greater selection of home loans and lock in the lowest interest rates.

Any cellular/mobile telephone number you provide may incur charges from your mobile service provider. Explore other calculators for specific mortgage loan types. Your loan term is the amount of time you have to pay off your mortgage balance. The origination charge covers items including fees, document preparation, and underwriting costs, and other expenses. You are more likely to get a better interest rate by comparing terms offered by multiple lenders, and it might be illuminating to see the loan amounts different lenders will qualify you for. And the impact on your budget may seem to be a stretch, particularly in the beginning.

A $400,000 home, with a 5% interest rate for 30 years and $20,000 (5%) down will require an annual income of $100,639. A $500,000 home, with a 5% interest rate for 30 years and $25,000 (5%) down will require an annual income of $124,192. This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area.

There are quite a few opportunities to get financial assistance with buying a home. If it’s your first time — or if you haven’t owned a home in the last three years — start by exploring the first-time homebuyer loans and programs that cater to your state or city. There are also grant programs, many of which are tailored to help low- and moderate-income borrowers with money that does not have to be paid back. Additionally, you might be able to get assistance based on your line of work. With home prices hitting record highs, you might wonder whether now is even a good time to buy a house. It’s important to focus on your personal situation instead of thinking about the overall real estate market.

So, if you’re buying a $400,000 home, your closing costs might range between $8,000 and $20,000. Some lenders might give you the option to roll those costs into the loan to avoid paying for them out-of-pocket. Keep in mind, though, that you’ll pay interest on them if you choose that option. The Federal Housing Administration is an agency of the U.S. government.

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the home’s price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your home’s value is higher. To obtain a conventional loan, many lenders prefer to approve a credit score of 680 and above .

Comments

Post a Comment